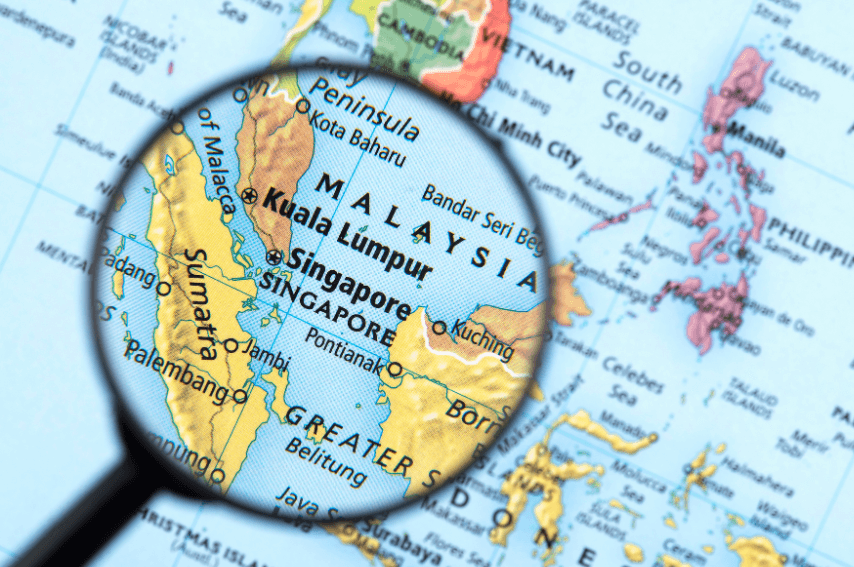

Forest City, located in Johor just minutes from Singapore, is quickly emerging as a premier destination for family offices in Asia. Strategically positioned and backed by strong government support, Forest City offers a compelling blend of tax incentives, regulatory flexibility, and a pro-business environment. As Malaysia continues to attract high-net-worth individuals seeking efficient wealth management solutions, Forest City stands out with its dedicated Special Financial Zone—making it a key player in the country’s growing family office ecosystem.

Why Forest City is Becoming a Hub for Family Offices

Forest City’s rise as a preferred destination for family offices is driven by its strategic location next to Singapore, offering easy cross-border access to one of Asia’s leading financial centres. With attractive tax incentives—including a 0% tax rate for qualifying family offices—and supportive regulatory policies under the Special Financial Zone, Forest City is tailored to meet the needs of high-net-worth individuals. The development boasts world-class infrastructure, a secure and private environment, and a streamlined setup process, making it ideal for families seeking long-term wealth preservation, succession planning, and business continuity in a stable jurisdiction.

Key Benefits of Forest City for Family Offices

Strategic Location and Proximity to Singapore

Forest City enjoys a prime location in Johor, just across the border from Singapore—one of the world’s top financial centres. This close proximity allows family offices to easily access international banks, investment services, and professional advisors, while benefiting from Malaysia’s lower operating costs and regulatory flexibility. It also ensures excellent regional connectivity for global business operations.

Attractive Tax Incentives and Business-Friendly Environment

The Malaysian government has introduced generous tax incentives to attract family offices to Forest City. These include exemptions on foreign-sourced income, capital gains, and inheritance taxes, alongside a 0% tax rate on eligible investment income for qualifying family offices. Combined with simplified regulatory processes and a welcoming stance toward foreign investors, Forest City offers an ideal setting for long-term wealth structuring and tax efficiency.

State-of-the-Art Infrastructure and Amenities

Forest City is designed as a modern, smart city equipped with high-end infrastructure and lifestyle amenities. From luxury residences and international schools to healthcare facilities and integrated business parks, the development supports both personal and professional needs. This makes it a seamless environment for families to live, operate their offices, and manage multigenerational wealth in one secure, well-connected location.

Why Forest City is Ideal for Multi-Generational Wealth Management

Forest City offers a unique setting for families focused on preserving and growing wealth across generations. Its dedicated Special Financial Zone provides a stable, tax-efficient environment tailored for long-term estate and succession planning. Family offices established here benefit from legal clarity, financial incentives, and access to professional services, all essential for effective wealth transfer. Coupled with integrated residential and commercial facilities, Forest City enables families to live, manage assets, and plan for the future in one cohesive location—making it an ideal choice for sustainable, multi-generational wealth management.

Conclusion

Forest City is rapidly positioning itself as a strategic hub for family offices in Asia, offering a rare combination of tax benefits, modern infrastructure, and proximity to global financial services. For high-net-worth families seeking a long-term, secure, and efficient base for wealth management, Forest City presents a compelling opportunity.

Discover how Forest City can work for your family’s future—get in touch with us today.